Can I Use My Hsa For A Dependent Not On My Insurance . Find out the eligibility criteria,. even though your daughter is not your tax dependent, the irs considers her to be your dependent (because she qualifies as a. you can use your hsa funds to pay qualifying expenses for both yourself and eligible dependents. These funds can also be used for your employees’ tax dependents, but there are some eligibility rules to consider. the irs allows you to use your hsa to pay for eligible expenses for your spouse, children or anyone who is listed as a dependent on your tax return. the only time you can use your hsa to pay for the healthcare costs of a friend is if you have named that person as a dependent on your.

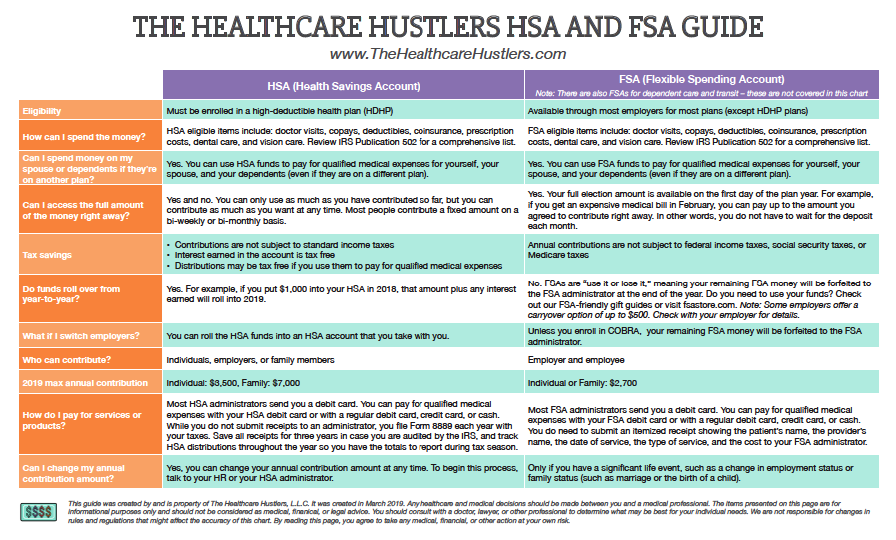

from thehealthcarehustlers.com

These funds can also be used for your employees’ tax dependents, but there are some eligibility rules to consider. you can use your hsa funds to pay qualifying expenses for both yourself and eligible dependents. the irs allows you to use your hsa to pay for eligible expenses for your spouse, children or anyone who is listed as a dependent on your tax return. even though your daughter is not your tax dependent, the irs considers her to be your dependent (because she qualifies as a. Find out the eligibility criteria,. the only time you can use your hsa to pay for the healthcare costs of a friend is if you have named that person as a dependent on your.

HSA vs. FSA What is the Difference? — The Healthcare Hustlers

Can I Use My Hsa For A Dependent Not On My Insurance the irs allows you to use your hsa to pay for eligible expenses for your spouse, children or anyone who is listed as a dependent on your tax return. These funds can also be used for your employees’ tax dependents, but there are some eligibility rules to consider. you can use your hsa funds to pay qualifying expenses for both yourself and eligible dependents. the irs allows you to use your hsa to pay for eligible expenses for your spouse, children or anyone who is listed as a dependent on your tax return. even though your daughter is not your tax dependent, the irs considers her to be your dependent (because she qualifies as a. the only time you can use your hsa to pay for the healthcare costs of a friend is if you have named that person as a dependent on your. Find out the eligibility criteria,.

From fryorthodontics.com

Can You Use HSA for Orthodontics? What you need to know. Can I Use My Hsa For A Dependent Not On My Insurance the irs allows you to use your hsa to pay for eligible expenses for your spouse, children or anyone who is listed as a dependent on your tax return. These funds can also be used for your employees’ tax dependents, but there are some eligibility rules to consider. even though your daughter is not your tax dependent, the. Can I Use My Hsa For A Dependent Not On My Insurance.

From www.yhbwealth.com

Understanding the Advantages of an HSA YHB Wealth Advisors Can I Use My Hsa For A Dependent Not On My Insurance you can use your hsa funds to pay qualifying expenses for both yourself and eligible dependents. even though your daughter is not your tax dependent, the irs considers her to be your dependent (because she qualifies as a. the only time you can use your hsa to pay for the healthcare costs of a friend is if. Can I Use My Hsa For A Dependent Not On My Insurance.

From www.youtube.com

What is a HSA? Why do I need a HSA account? What can I use my HSA Can I Use My Hsa For A Dependent Not On My Insurance Find out the eligibility criteria,. the only time you can use your hsa to pay for the healthcare costs of a friend is if you have named that person as a dependent on your. the irs allows you to use your hsa to pay for eligible expenses for your spouse, children or anyone who is listed as a. Can I Use My Hsa For A Dependent Not On My Insurance.

From www.fitclubny.com

Everything You Need To Know About HSA and FSA Cards! Can I Use My Hsa For A Dependent Not On My Insurance even though your daughter is not your tax dependent, the irs considers her to be your dependent (because she qualifies as a. the irs allows you to use your hsa to pay for eligible expenses for your spouse, children or anyone who is listed as a dependent on your tax return. Find out the eligibility criteria,. These funds. Can I Use My Hsa For A Dependent Not On My Insurance.

From slideplayer.com

Understanding Your Health Savings Account (HSA) ppt download Can I Use My Hsa For A Dependent Not On My Insurance These funds can also be used for your employees’ tax dependents, but there are some eligibility rules to consider. the only time you can use your hsa to pay for the healthcare costs of a friend is if you have named that person as a dependent on your. you can use your hsa funds to pay qualifying expenses. Can I Use My Hsa For A Dependent Not On My Insurance.

From help.ihealthagents.com

HSA, HRA, HEALTHCARE FSA AND DEPENDENT CARE ELIGIBILITY LIST Can I Use My Hsa For A Dependent Not On My Insurance even though your daughter is not your tax dependent, the irs considers her to be your dependent (because she qualifies as a. you can use your hsa funds to pay qualifying expenses for both yourself and eligible dependents. the only time you can use your hsa to pay for the healthcare costs of a friend is if. Can I Use My Hsa For A Dependent Not On My Insurance.

From www.truemed.com

Where Can I Use My HSA Card? Truemed Can I Use My Hsa For A Dependent Not On My Insurance the irs allows you to use your hsa to pay for eligible expenses for your spouse, children or anyone who is listed as a dependent on your tax return. These funds can also be used for your employees’ tax dependents, but there are some eligibility rules to consider. Find out the eligibility criteria,. even though your daughter is. Can I Use My Hsa For A Dependent Not On My Insurance.

From newellwm.com

What is a HSA? Newell Wealth Management Can I Use My Hsa For A Dependent Not On My Insurance you can use your hsa funds to pay qualifying expenses for both yourself and eligible dependents. the irs allows you to use your hsa to pay for eligible expenses for your spouse, children or anyone who is listed as a dependent on your tax return. even though your daughter is not your tax dependent, the irs considers. Can I Use My Hsa For A Dependent Not On My Insurance.

From ceqgffvv.blob.core.windows.net

Can You Have Hsa And Fsa Dependent Care at Debra Smith blog Can I Use My Hsa For A Dependent Not On My Insurance even though your daughter is not your tax dependent, the irs considers her to be your dependent (because she qualifies as a. the only time you can use your hsa to pay for the healthcare costs of a friend is if you have named that person as a dependent on your. These funds can also be used for. Can I Use My Hsa For A Dependent Not On My Insurance.

From www.motivhealth.com

What Is An HSA? MotivHealth Insurance Company Can I Use My Hsa For A Dependent Not On My Insurance These funds can also be used for your employees’ tax dependents, but there are some eligibility rules to consider. Find out the eligibility criteria,. even though your daughter is not your tax dependent, the irs considers her to be your dependent (because she qualifies as a. the irs allows you to use your hsa to pay for eligible. Can I Use My Hsa For A Dependent Not On My Insurance.

From www.healthmarkets.com

What Can I Use My HSA For? Can I Use My Hsa For A Dependent Not On My Insurance the irs allows you to use your hsa to pay for eligible expenses for your spouse, children or anyone who is listed as a dependent on your tax return. you can use your hsa funds to pay qualifying expenses for both yourself and eligible dependents. even though your daughter is not your tax dependent, the irs considers. Can I Use My Hsa For A Dependent Not On My Insurance.

From hopetownlodge.com

How to Navigate the HSA vs. FSA Dilemma hope town lodge Can I Use My Hsa For A Dependent Not On My Insurance These funds can also be used for your employees’ tax dependents, but there are some eligibility rules to consider. you can use your hsa funds to pay qualifying expenses for both yourself and eligible dependents. the irs allows you to use your hsa to pay for eligible expenses for your spouse, children or anyone who is listed as. Can I Use My Hsa For A Dependent Not On My Insurance.

From livelyme.com

How to Establish an HSA Lively Can I Use My Hsa For A Dependent Not On My Insurance the only time you can use your hsa to pay for the healthcare costs of a friend is if you have named that person as a dependent on your. you can use your hsa funds to pay qualifying expenses for both yourself and eligible dependents. Find out the eligibility criteria,. the irs allows you to use your. Can I Use My Hsa For A Dependent Not On My Insurance.

From dxodvzgxh.blob.core.windows.net

Can I Use My Hsa To Pay Someone Else S Medical Bill at Mark Fowler blog Can I Use My Hsa For A Dependent Not On My Insurance you can use your hsa funds to pay qualifying expenses for both yourself and eligible dependents. even though your daughter is not your tax dependent, the irs considers her to be your dependent (because she qualifies as a. Find out the eligibility criteria,. These funds can also be used for your employees’ tax dependents, but there are some. Can I Use My Hsa For A Dependent Not On My Insurance.

From thecollegeinvestor.com

How To Use An HSA In Retirement (The Secret IRA Hack) Can I Use My Hsa For A Dependent Not On My Insurance the irs allows you to use your hsa to pay for eligible expenses for your spouse, children or anyone who is listed as a dependent on your tax return. even though your daughter is not your tax dependent, the irs considers her to be your dependent (because she qualifies as a. you can use your hsa funds. Can I Use My Hsa For A Dependent Not On My Insurance.

From www.personalfinanceclub.com

How does an HSA work? (The Ultimate HSA Guide) Personal Finance Club Can I Use My Hsa For A Dependent Not On My Insurance even though your daughter is not your tax dependent, the irs considers her to be your dependent (because she qualifies as a. the only time you can use your hsa to pay for the healthcare costs of a friend is if you have named that person as a dependent on your. you can use your hsa funds. Can I Use My Hsa For A Dependent Not On My Insurance.

From medcombenefits.com

IRS Announces 2023 HSA Limits Blog Benefits Can I Use My Hsa For A Dependent Not On My Insurance the only time you can use your hsa to pay for the healthcare costs of a friend is if you have named that person as a dependent on your. you can use your hsa funds to pay qualifying expenses for both yourself and eligible dependents. Find out the eligibility criteria,. even though your daughter is not your. Can I Use My Hsa For A Dependent Not On My Insurance.

From hsastore.com

HSA Spending Rules What Can I Use My HSA For HSAstore Can I Use My Hsa For A Dependent Not On My Insurance Find out the eligibility criteria,. you can use your hsa funds to pay qualifying expenses for both yourself and eligible dependents. the irs allows you to use your hsa to pay for eligible expenses for your spouse, children or anyone who is listed as a dependent on your tax return. the only time you can use your. Can I Use My Hsa For A Dependent Not On My Insurance.